skylab-promo.online

Prices

How To Knock Down The Price Of A Car

Key Takeaways · Do your online research first to identify the type of car you want and the price range you can expect. · Set your maximum price in advance and. If they don't want to shift on price, ask if they'll throw in some optional extras as incentives instead, such as car insurance, a more favourable car finance. If a car is in high demand, a dealership can charge far more than the sticker price. When demand is lower, you can expect to pay less than the sticker price. A. How to get the best price for your car · Condition. One of the most obvious, yet impactful factors to consider when selling your car is the current condition of. Before you trade in or sell your old vehicle, be sure to remove the license plates and the windshield registration sticker, which shows your plate number. This. Cutting down on insurance costs by considering your predicted monthly mileage and where you store the car can also help, but make sure you're always honest with. You may be able to talk down the price as much as ten percent or more sometimes, depending on how much the dealer paid for the car. Flaws that. Make it clear you're willing to entertain the “old” car if they make the price less than a younger (a similar car that has spent very little time in inventory). Dealers make bigger profits on finance deals, so let them bargain the car's price on this basis. You can then decline the finance deal later in the process. Key Takeaways · Do your online research first to identify the type of car you want and the price range you can expect. · Set your maximum price in advance and. If they don't want to shift on price, ask if they'll throw in some optional extras as incentives instead, such as car insurance, a more favourable car finance. If a car is in high demand, a dealership can charge far more than the sticker price. When demand is lower, you can expect to pay less than the sticker price. A. How to get the best price for your car · Condition. One of the most obvious, yet impactful factors to consider when selling your car is the current condition of. Before you trade in or sell your old vehicle, be sure to remove the license plates and the windshield registration sticker, which shows your plate number. This. Cutting down on insurance costs by considering your predicted monthly mileage and where you store the car can also help, but make sure you're always honest with. You may be able to talk down the price as much as ten percent or more sometimes, depending on how much the dealer paid for the car. Flaws that. Make it clear you're willing to entertain the “old” car if they make the price less than a younger (a similar car that has spent very little time in inventory). Dealers make bigger profits on finance deals, so let them bargain the car's price on this basis. You can then decline the finance deal later in the process.

If you can quote prices from other cars in the area, the seller might be more willing to bring down the price. Remember, they want to make the sale, and if they. It's unlikely you'll ever get a dealer to bargain all the way down to their holdback price, since they need to make a profit to stay in business. Just be aware. If you are thinking about buying your car from a dealership, a great way to negotiate a cheaper price is by trading in your current vehicle. Ask the dealer what. A knock-down kit is a kit containing the parts needed to assemble a product. The parts are typically manufactured in one country or region, then exported to. Our free guide reveals how to negotiate car price, insider tips on how to save money on your next car, and additional coverage options to consider. Cap cost reduction: Also known as capital cost reduction, this covers any up-front payments that lower the amount you finance. This could include trade-in. How to determine the best price if you are going to buy a demo car from a dealer. You will learn how to account for the depreciation and make a fair offer. Many factors can influence the deal you're negotiating. Things like: what's the average selling price of similar cars, was the scheduled maintenance kept up. Research is key to undertaking any negotiation regarding the cost of a car. The more you know about the vehicle you're interested in buying, the better. How to negotiate a car price: top tips · Does the thought of haggling for the best new car price make you anxious? Read our guide and relax! · Doing your homework. Dealers make bigger profits on finance deals, so let them bargain the car's price on this basis. You can then decline the finance deal later in the process. How to Negotiate the Best Auto Loan Rate with the Finance Office · Vehicle Service Contract (also known as an extended warranty) · GAP coverage – In the event of. First settle on the price for the vehicle you're buying, then discuss your trade-in or financing terms separately. Salespeople often try to get you to focus on. Add these figures to the wholesale price to come up with the minimum price you should accept from a private party. For example, if you want $2, over. When negotiating on price with the dealer or seller, explain the information identified on the report and set out the amount of discount you are looking for. It. You have to know how to negotiate used car prices, know what to research and understand exactly how much the listed price is negotiable. There are a multitude. After the title is transferred, remove the license plates from the vehicle and return the plates to the MVA unless you are transferring the plates to another. The seller should remove the license plate from the vehicle at the time of the transaction. When you purchase a vehicle in Indiana, you must pay sales tax on. Instead, go in with a price that's below your budget, and work from there. Use the vehicle's condition to your advantage. Faults aren't uncommon on used cars. If you start shopping for a new car, you may encounter dealers who refuse to budge from the vehicle's posted window sticker price. In other words, they aren't.

Steps To Learn Coding For Beginners

Throughout this course, you will learn the fundamental programming concepts. You will read short lessons, solve challenges and projects, one step at a time. Try. To get started with programming, the easiest way is to take an online course. This includes learning concepts such as variables, functions, methods, operators. For blogs and tutorials, a simple google search like "best python tutorial" or "best swift tutorial for beginners" is a great place to start. Coding is a process that takes directions from humans and turns them into languages that computers can understand. Coders use coding software and programming. Online coding courses are one of the best ways to get a feel for a new programming language. There are numerous tutors and websites that provide courses aimed. In this article, we will discuss how can you start learning C by following some simple steps. Are you ready to learn? Then, let's dive in! What is coding? Coding involves giving a computer a set of instructions to execute using a programming language like Python or Java. · How is code used? · What. With the right motivation, anyone can become highly proficient in Python programming. As a beginner, I struggled to keep myself awake when trying to memorize. Consider Java or JavaScript. These are good languages to learn if you want to code websites (JavaScript) or mobile apps (Java). Throughout this course, you will learn the fundamental programming concepts. You will read short lessons, solve challenges and projects, one step at a time. Try. To get started with programming, the easiest way is to take an online course. This includes learning concepts such as variables, functions, methods, operators. For blogs and tutorials, a simple google search like "best python tutorial" or "best swift tutorial for beginners" is a great place to start. Coding is a process that takes directions from humans and turns them into languages that computers can understand. Coders use coding software and programming. Online coding courses are one of the best ways to get a feel for a new programming language. There are numerous tutors and websites that provide courses aimed. In this article, we will discuss how can you start learning C by following some simple steps. Are you ready to learn? Then, let's dive in! What is coding? Coding involves giving a computer a set of instructions to execute using a programming language like Python or Java. · How is code used? · What. With the right motivation, anyone can become highly proficient in Python programming. As a beginner, I struggled to keep myself awake when trying to memorize. Consider Java or JavaScript. These are good languages to learn if you want to code websites (JavaScript) or mobile apps (Java).

Use this guide to help you quickly create a programming environment on your computer, then in easy steps, learn how to: write Python code to create your. While it might come as a surprise, kids can start learning basic programming as early as 5 years old, and sometimes even younger. Even before they can read. Step 1: Ask Yourself, “Why Should I Learn to Code?” · Step 2: Choose the Right Coding Tools and Software to Get Started · Step 3: Pick the Right Programming. For blogs and tutorials, a simple google search like "best python tutorial" or "best swift tutorial for beginners" is a great place to start. To code, start by choosing a programming language that you want to learn, like HTML5 or C++, which are basic languages for beginners. Use free resources. To code, start by choosing a programming language that you want to learn, like HTML5 or C++, which are basic languages for beginners. Use free resources. But if you want to dive right into learning the computer languages, like C++ and Java, that run operating systems, networks, and software, [computer programming]. You need have no previous knowledge of any computer programming language so it's ideal for the newcomer, including youngsters needing to learn programming. An experienced programmer in any programming language (whatever it may be) can pick up Python very quickly. It's also easy for beginners to use and learn. We will get familiar with the idea of programming languages and development platforms, along with concepts like compilation and code execution. We are going to. 3 simple steps to start learning how to code · 1. Explore. To begin—and this may go without saying—find areas of technology that excite you. · 2. Learn. There are. Coding for Beginners in easy steps, 2nd edition will appeal to anyone, of any age, who wants to begin coding computer programs. There are several different paths you can take toward this career as a coding beginner. You could invest in a college course, attend a skills boot camp, or use. For someone learning from the very beginning I suggest looking for and learning about Object Oriented Programming, learn Data Structures first. AI-assisted learningMake progress faster with our AI Learning Assistant, a tool that automatically understands your current course, instructions, and solution. Codecademy is an online learning platform that offers free coding classes in programming languages including Python, Java, JavaScript, Ruby, SQL, C++, HTML, and. Though it may seem daunting at first, consider starting small with 25 minutes everyday and working your way up from there. Check out the First Steps With Python. Are you interested in learning how to code but lack knowledge of computer programming? If so, the first step is to study a programming language that's easy to. Month Basics of Python and data manipulation. Master basic and intermediate programming concepts. Start doing basic projects in your specialized field. For. Your First Webpage in an Hour! Grades 9+ | HTML, CSS. Introduction to Machine Learning. Grades 6+ | Language.

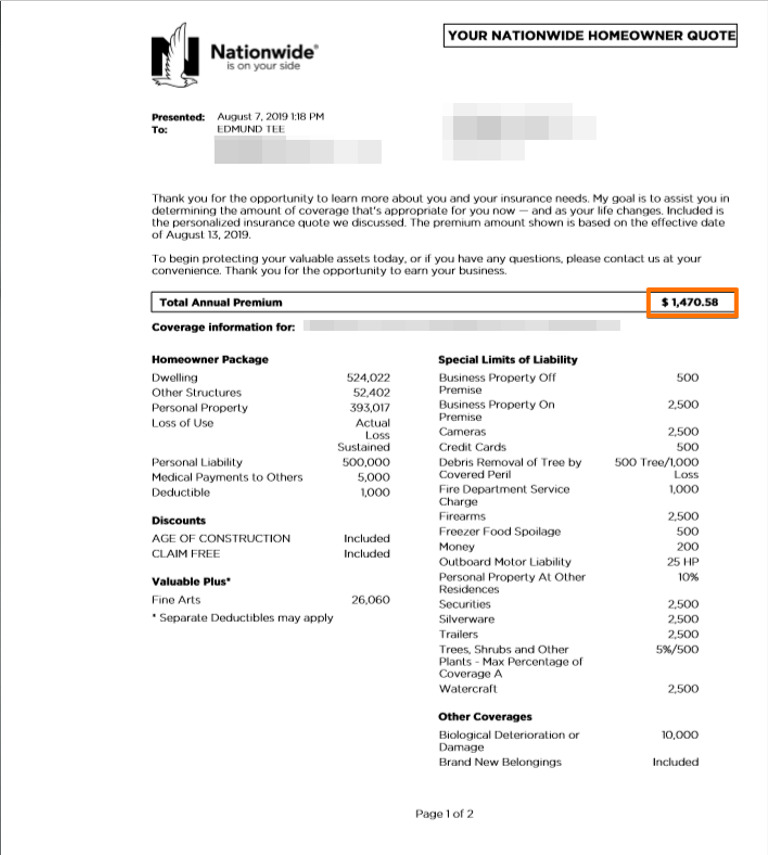

What Is Annual Homeowners Insurance

Homeowners insurance covers the structure of your home and your personal property, as well as your personal legal responsibility (or liability) for injuries to. The Colorado Division of Insurance has created this Homeowners Insurance Interactive Premium Comparison Report to provide consumers an opportunity to compare. Average cost of homeowners insurance by state ; Georgia, $1, ; Hawaii, $ ; Idaho, $ ; Illinois, $ The link below takes you to the webpage that includes average coverage amounts for Coverage A (main structure) and Coverage C (personal property), earned. If you have a mortgage lender, you usually pay for the first year of your homeowners insurance upfront before or the closing of your house. On average, homeowners insurance in the U.S. costs about $2, per year, according to a recent report from Insurify. It covers your home and other structures. The national average homeowners insurance cost is $ and has been steadily increasing each year. ✓ Get details and learn how to keep costs down! How much does homeowners insurance cost? The average annual homeowners insurance premium runs about $1, However, it can be much higher or lower based on. Your home insurance policy is a legal contract of the promise that an insurance company gives you for a specified period of time (usually one-year) to pay. Homeowners insurance covers the structure of your home and your personal property, as well as your personal legal responsibility (or liability) for injuries to. The Colorado Division of Insurance has created this Homeowners Insurance Interactive Premium Comparison Report to provide consumers an opportunity to compare. Average cost of homeowners insurance by state ; Georgia, $1, ; Hawaii, $ ; Idaho, $ ; Illinois, $ The link below takes you to the webpage that includes average coverage amounts for Coverage A (main structure) and Coverage C (personal property), earned. If you have a mortgage lender, you usually pay for the first year of your homeowners insurance upfront before or the closing of your house. On average, homeowners insurance in the U.S. costs about $2, per year, according to a recent report from Insurify. It covers your home and other structures. The national average homeowners insurance cost is $ and has been steadily increasing each year. ✓ Get details and learn how to keep costs down! How much does homeowners insurance cost? The average annual homeowners insurance premium runs about $1, However, it can be much higher or lower based on. Your home insurance policy is a legal contract of the promise that an insurance company gives you for a specified period of time (usually one-year) to pay.

Nationally, homeowners pay an average premium of $ per year. A home insurance deductible is the amount of a covered claim that is your responsibility. More Prepare & Prevent. More Prepare & Prevent. Personal liability – Provides protection if the homeowner is legally responsible for property damage or injuries to others. It may help pay for legal expenses. If your policy contains a standard all-peril deductible, such as $, you would receive from your insurer the amount of any covered property loss, less $ A homeowners insurance premium is the amount of money you pay to keep a policy active. This guide explains how a homeowners insurance premium works. Like auto insurance, the cost of homeowner's coverage depends largely on where you live. Crime rates vary from community to community, as does access to. Getting the right amount of homeowners coverage will give you the peace of mind you need to get on with your life. Homeowners insurance policies generally cover destruction and damage to a residence's interior and exterior, the loss or theft of possessions, and personal. What Is Homeowners Insurance? A home insurance policy provides coverage to repair or replace your home and its contents following damage caused by fire, smoke. Lenders will estimate your homeowners insurance premium and real-estate property taxes yearly. Remember, it's an estimate so at the end of the year you may. The average cost of homeowners insurance is $ per year, but rates vary greatly depending on the company, your coverage needs and your house's rebuild. Note: Average premium=Premiums/exposure per house years. A house year is equal to days of insured coverage for a single dwelling. The NAIC does not rank. Personal property coverage Personal property coverage is part of a standard homeowners insurance policy. If your clothes, appliances, electronics, furniture. Homeowners insurance policies generally cover destruction and damage to a residence's interior and exterior, the loss or theft of possessions, and personal. Note: Average premium=Premiums/exposure per house years. A house year is equal to days of insured coverage for a single dwelling. The NAIC does not rank. Here are the top 10 states with the lowest homeowners insurance premiums. State, Average Annual Homeowners Insurance Cost. Hawaii. $ Utah. $ Nevada. What is mortgage insurance? Mortgage insurance, also known as private mortgage insurance or PMI, is insurance that some lenders may require to protect their. We're talking about a homeowners insurance checkup, a task you should complete yearly, ideally around renewal time. It will help you verify that your policy. How much does home insurance cost? Find out how much you can expect to pay monthly or yearly so you're prepared to shop and save. The amount a buyer would pay for a home, including the land, regardless of how much it would cost to rebuild the home. What is replacement cost? Replacement.

Top Ten Trading Platforms

Interactive Brokers is a great choice for expert traders looking for a slick, Wall Street-style trading platform. Sometimes called IBKR for short, Interactive. The broker's comprehensive educational resources and advanced platform features make it a good fit for those looking to develop their trading. Some of the top trading platforms in the U.S. include Ally Invest, Robinhood, and Firstrade for beginners, Interactive Brokers, TD Ameritrade, and E*TRADE for. Traders at Schwab now get the best in trading—award-winning platforms, tailored education, and specialized support—all from one of the most trusted brands in. Best online brokerage trading platforms in September Charles Schwab; Fidelity Investments; Interactive Brokers; Ally Invest; E-Trade; Merrill Edge. For high-volume traders, we have chosen Lightspeed, a division of Lime Brokerage. Lightspeed is known for its many trading platforms, day-trading services, and. Finally, moomoo holds the best international trading platform award for Chinese stocks. International investors will find each global trading platform opens the. IQ Option is an award-winning mobile trading platform*. It has clean and intuitive interface, created to meet the needs of the most demanding traders. It is all in one trading platform for any asset class that you want to trade. The UI is very user friendly and easy to learn and operate. Read reviews. Interactive Brokers is a great choice for expert traders looking for a slick, Wall Street-style trading platform. Sometimes called IBKR for short, Interactive. The broker's comprehensive educational resources and advanced platform features make it a good fit for those looking to develop their trading. Some of the top trading platforms in the U.S. include Ally Invest, Robinhood, and Firstrade for beginners, Interactive Brokers, TD Ameritrade, and E*TRADE for. Traders at Schwab now get the best in trading—award-winning platforms, tailored education, and specialized support—all from one of the most trusted brands in. Best online brokerage trading platforms in September Charles Schwab; Fidelity Investments; Interactive Brokers; Ally Invest; E-Trade; Merrill Edge. For high-volume traders, we have chosen Lightspeed, a division of Lime Brokerage. Lightspeed is known for its many trading platforms, day-trading services, and. Finally, moomoo holds the best international trading platform award for Chinese stocks. International investors will find each global trading platform opens the. IQ Option is an award-winning mobile trading platform*. It has clean and intuitive interface, created to meet the needs of the most demanding traders. It is all in one trading platform for any asset class that you want to trade. The UI is very user friendly and easy to learn and operate. Read reviews.

Our award-winning online trading platform: Is engineered for reliability and speed, making it great for high volatility trading; Helps to ensure you never miss. Identifying the best online trading platform for you ; Questrade. Quest Mobile lets you: Make trades; Research securities; Move money; Monitor portfolio. Best Trading Apps for iPhone and Mac. Here's a collection of trading Best Trading Platforms that received good ratings from Mac and iPhone users. Robinhood. Soros's most famous trade occurred on September 16, , a day forever known as «Black Wednesday.» He took a massive short position against the British pound. AvaSocial sets a new standard in social trading technology. With the AvaSocial mobile app, you can follow and copy the trades of the very best traders. Use the. Best Online Brokerage Accounts and Trading Platforms of Best Overall: Fidelity; Best for Low Costs: Fidelity; Best for Beginners: Charles Schwab; Best for. We can help you find a good solution without compromising on cost or performance. Help me Pick a Platform. Pricing: FREE. Datafeed: Optimus Futures. Optimus. Interactive Brokers is an online brokerage platform that offers a unified platform for trading stocks, options, futures, currencies, bonds, and funds. They. Inspiration. See what other traders are doing, and come up with your own great ideas right inside our platform. All for free! With years of history and background in the global exchange markets, TenTrade pride ourselves on providing the best possible trade conditions that are based. Binance is a global blockchain and cryptocurrency infrastructure provider with a financial product suite that boasts the largest digital asset exchange by. IG and CMC Markets are easy to use, offer lots of educational material, trading signals, and seminars and are well established. eToro is also a good choice as. Best Online Brokers in · Our Top Brokers · Charles Schwab · Fidelity · Interactive Brokers · Ally Invest · E-Trade · Merrill Edge · Robinhood. Reliability is the first factor as whatever you trade, only if you could get back your profits, would it make sense to do any good trading at all. So, the. eToro: This platform is awesome if you're interested in copy trading. They have the biggest copy trading community in the world with over 3, For high-volume traders, we have chosen Lightspeed, a division of Lime Brokerage. Lightspeed is known for its many trading platforms, day-trading services, and. Made to trade ; skylab-promo.online · Tradable assets: Forex ; moomoo · Tradable assets: Stocks, ETFs ; AMP Futures · Tradable assets: Futures ; Webull · Tradable assets: Stocks. Overall, interactive investor could be a good choice for investors looking for a wide range of investments, and investors with higher-value portfolios due to. Remember when TradeZero was the hot ticket online trading company that offered zero commissions? They used to be one of the top trading platforms. They are. That's one of the largest lists of free funds that you'll anywhere today. E*TRADE has a beginner-friendly platform as well as a robust trading platform, called.

How Big Of A Mortgage Can I Get

Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. This video shows you how your mortgage payment should fit comfortably into your lifestyle. Learn more about how much mortgage you can afford. Find a down. First, a standard rule for lenders is that your monthly housing payment should not take up more than 28% of your gross monthly income. The 28% and 36% ratios are standard in the mortgage world, but lenders may have other combinations available, such as 33%/38%. Every lender is going to have a different threshold, but a good ballpark figure is to keep your back-end ratio under 36% for all debt payments, including. How many times my salary can I borrow for a mortgage? Many lenders will allow you to borrow up to times your salary. There may be some lenders whose. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. Both ratios are important factors in determining whether the lender will make the loan. What do lenders generally require? Lenders usually require the PITI. Find out how much you're likely to be able to borrow on your income with Money Saving Expert's mortgage calculator. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. This video shows you how your mortgage payment should fit comfortably into your lifestyle. Learn more about how much mortgage you can afford. Find a down. First, a standard rule for lenders is that your monthly housing payment should not take up more than 28% of your gross monthly income. The 28% and 36% ratios are standard in the mortgage world, but lenders may have other combinations available, such as 33%/38%. Every lender is going to have a different threshold, but a good ballpark figure is to keep your back-end ratio under 36% for all debt payments, including. How many times my salary can I borrow for a mortgage? Many lenders will allow you to borrow up to times your salary. There may be some lenders whose. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. Both ratios are important factors in determining whether the lender will make the loan. What do lenders generally require? Lenders usually require the PITI. Find out how much you're likely to be able to borrow on your income with Money Saving Expert's mortgage calculator.

To determine how much you can afford using this rule, multiply your monthly gross income by 28%. For example, if you make $10, every month, multiply $10, Get your FICO ® Score for free. 90% of top lenders use FICO ® Scores This tool calculates loan amounts and mortgage payments for two underwriting. It is recommended that your DTI should be less than 36% to ensure that you have some padding on your monthly spend. A good DTI greatly impacts your ability to. Remember the mortgage rule of thumb-- no more than 36% of your gross monthly income should go toward debts, including a mortgage. And your mortgage shouldn't be. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. First time buyers maximum mortgage level is 4 times your gross annual income with the mortgage capped at 90% of the purchase price. Mortgage Type: The type of mortgage you choose can have a dramatic impact on the amount of house you can afford, especially if you have limited savings. FHA. Another clue to examining home affordability is the 28/36 rule. Lenders use this to zero in on what you currently owe and how a mortgage will impact that debt. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. For example, borrowing $, to buy a $, home equals % LTV. Lenders can offer VA or USDA loans at % LTV, but not everyone is eligible for these. The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much as possible but take a. Use our calculator to get a sense of how much house you can afford This calculator can give you a general idea of what size mortgage you can afford. Getting Pre-Qualified. Mortgage pre-qualification is an informal estimate of how much money you can borrow for a home loan. It usually takes just one to three. Home equity calculator Calculate how much you can borrow. Explore all The current interest rate you could receive on your mortgage. This is used. Lenders can actually approve up to 50% DTI but 42% is a more conservative DTI for affordability. Assuming credit over With a % interest. How Much Can You Borrow? · You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Related Resources. Use the LendingTree home affordability calculator to help you analyze multiple scenarios and mortgage types to find out how much house you can afford. A mortgage pre-qualification is a rough estimate of your borrowing capacity to purchase a property. It's calculated based on your basic financial information.

How Phishing Scams Work

In a phishing scam, you could be redirected to a phony Website that may look exactly like the real thing. Sometimes, in fact, it may be the company's actual. Phishing is a type of attack carried out in order to steal information or money. Phishing attacks can occur through email, phone calls, texts, instant. Scammers use email or text messages to trick you into giving them your personal and financial information. But there are several ways to protect yourself. Phishing (pronounced “fishing”) is a form of online scam where “phishers” attempt to gain customer account information such as user names, passwords, PINs. The first wave of phishing came about through sending scam emails, where the victim would unintentionally click a malicious link and be redirected to a fake. A phishing attack is simply when a stranger pretends to be someone you trust in order to persuade you to give them information you'd only ever. Phishing is a type of social engineering attack often used to steal user data, including login credentials and credit card numbers. These scams are designed to trick you into giving information to criminals that they shouldn't have access to. In a phishing scam, you might receive an email. Cyberattacks called phishing use deceptive "social engineering" techniques to trick people into divulging sensitive data, transferring money, and more. In a phishing scam, you could be redirected to a phony Website that may look exactly like the real thing. Sometimes, in fact, it may be the company's actual. Phishing is a type of attack carried out in order to steal information or money. Phishing attacks can occur through email, phone calls, texts, instant. Scammers use email or text messages to trick you into giving them your personal and financial information. But there are several ways to protect yourself. Phishing (pronounced “fishing”) is a form of online scam where “phishers” attempt to gain customer account information such as user names, passwords, PINs. The first wave of phishing came about through sending scam emails, where the victim would unintentionally click a malicious link and be redirected to a fake. A phishing attack is simply when a stranger pretends to be someone you trust in order to persuade you to give them information you'd only ever. Phishing is a type of social engineering attack often used to steal user data, including login credentials and credit card numbers. These scams are designed to trick you into giving information to criminals that they shouldn't have access to. In a phishing scam, you might receive an email. Cyberattacks called phishing use deceptive "social engineering" techniques to trick people into divulging sensitive data, transferring money, and more.

Phishing persuades you to take an action which gives a scammer access to your device, accounts, or personal information. Email Phishing scams are carried out online by tech-savvy con artists and identity theft criminals. They use spam, fake websites constructed to look. Phishing occurs when criminals try to get us to open harmful links, emails or attachments that could request our personal information or infect our devices. WHAT IS PHISHING? · attempt to gain access to information you hold on your device; · steal money from you or others at the organisation you work for; or · attempt. Phishing is a type of social engineering attack in which cyber criminals trick victims into handing over sensitive information or installing malware. Phishing scams are attempts by someone to deceive you into disclosing personal or financial information that they can use to steal your money, identity or both. Phishing is a type of online scam that targets consumers by sending them an e-mail that appears to be from a well-known source. How it Works Phishers may contact you through a fraudulent email, phone call, or a fake website. They often disguise themselves as reputable companies, such. Phishing is first and foremost a cybercrime. In a phishing scam, a target is contacted by email, telephone or text message by someone posing as a close. Phishing is a type of cybersecurity attack during which malicious actors send messages pretending to be a trusted person or entity. Phishing is when attackers send scam emails (or text messages) that contain links to malicious websites. The websites may contain malware (such as ransomware). How Phishing Works Whether a phishing campaign is hyper-targeted or sent to as many victims as possible, it starts with a malicious message. An attack is. Phishing is a form of social engineering and a scam where attackers deceive people into revealing sensitive information or installing malware such as. How Does Phishing Work? · Weaponize It: If capturing credentials is the aim, an attacker will likely build a fake login page to complement their phony emails. Here are some ways to recognize a phishing email: Urgent call to action or threats - Be suspicious of emails and Teams messages that claim you must click, call. Common Features of Phishing Emails · Too Good To Be True - Lucrative offers and eye-catching or attention-grabbing statements are designed to attract people's. Phishing may also occur in the form of emails or texts from scammers that are made to appear as if they are sent from a legitimate business. These fake emails. Attacks can range from some kind of malicious code on the page executing in your browser (not gonna fully compromise your machine but there can. Simply put, it is a type of scam, often executed by emails, text messages, or phone calls, in which a malicious actor manipulates their target into sharing.

Home Rates 30 Year Fixed

Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. A year fixed-rate mortgage is a home loan repaid over 30 years with an interest rate that does not change. The year period is your “loan term,” and. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Refinance ; year fixed mortgage · % · % ; year fixed mortgage · % · %. Today's current year, fixed-rate mortgage rates* · Purchase price: $, · Down payment: % · First Lien Position · Primary residence · FICO Score. 30 Yr. Jumbo, %, --, +%. Today. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. Mortgage Rates Remained Flat This Week. September 5, Mortgage rates remained flat this week as markets await the release of the highly anticipated. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. A year fixed-rate mortgage is a home loan repaid over 30 years with an interest rate that does not change. The year period is your “loan term,” and. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Refinance ; year fixed mortgage · % · % ; year fixed mortgage · % · %. Today's current year, fixed-rate mortgage rates* · Purchase price: $, · Down payment: % · First Lien Position · Primary residence · FICO Score. 30 Yr. Jumbo, %, --, +%. Today. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. Mortgage Rates Remained Flat This Week. September 5, Mortgage rates remained flat this week as markets await the release of the highly anticipated.

*** 5/5 fixed-to-adjustable rate: Initial % (% APR) is fixed for 5 years, then adjusts every five years based on an index and margin. For a year. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The 30 Year Mortgage. Year Fixed Mortgage Rates* ; , % ; , % ; , % ; , %. When you apply and are approved for a year fixed-rate mortgage, two things are certain. Your interest rate will not change and your mortgage will be broken. National year fixed mortgage rates remain stable at %. The current average year fixed mortgage rate remained stable at % on Sunday. Rates to refinance ; Year Fixed · % · % APR ; Year Fixed · % · % APR. The year fixed mortgage rate on September 10, is down 11 basis points from the previous week's average rate of %. Additionally, the current national. On Tuesday, September 10, , the current average interest rate for a year fixed mortgage is %, down 7 basis points from a week ago. If you're looking. 8/30/, %. +%. +%, %. +%. +%. Today's year mortgage rates can be customized from major lenders. NerdWallet's 30 yr mortgage rates are based on a daily survey of national lenders. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Loan Options. All Home LoansYear FixedYear FixedAdjustable-Rate MortgageBorrowSmart AccessFHA LoanHomeReady® & Home Possible®Home Equity LoanJumbo. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Year Fixed Mortgage. Get a fixed interest rate and lower monthly payments. Take the first step toward buying a house. The rates shown above are the current rates for the purchase of a single-family primary residence based on a day lock period. Mortgage rates today · yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. 30 Year Fixed** · $ · % ; 15 Year Fixed** · $ · % ; 5yr/6mo ARM** · $ · % ; Home Construction Loan** · $ · % ; FHA Loan · $ · %.

Credit Card Facts

Credit cards have different interest rates. It is common for the interest rate on credit cards to be higher than the interest rates available from banks on. Use your Mastercard® credit card for everyday purchases — at stores, online and even places that don't accept cash or checks, like hotels. Credit cards are actually high-interest loans in disguise. Companies may lend you money, but they get it all back and a lot more by charging you fees. Annual. Here are some interesting facts on credit cards that you may not know about: Credit Card Fact #1: You are not Charged Interest on Purchases Right Away. Get ready to discover 20 fun facts about credit cards that will not only entertain, but also give you a deeper understanding of their impact on our financial. In its non-physical form, a credit card represents a payment mechanism which facilitates both consumer and commercial business transactions. Key Takeaways. Credit cards are plastic or metal cards used to pay for items or services using credit. Credit cards charge interest on the money spent. Here are five interesting or little known facts about credit cards you can bring up the next time there's a lull in the conversation. Credit cards have a credit limit that you can make purchases against, then repay at a later date. · Carrying a balance on a credit card can trigger interest. Credit cards have different interest rates. It is common for the interest rate on credit cards to be higher than the interest rates available from banks on. Use your Mastercard® credit card for everyday purchases — at stores, online and even places that don't accept cash or checks, like hotels. Credit cards are actually high-interest loans in disguise. Companies may lend you money, but they get it all back and a lot more by charging you fees. Annual. Here are some interesting facts on credit cards that you may not know about: Credit Card Fact #1: You are not Charged Interest on Purchases Right Away. Get ready to discover 20 fun facts about credit cards that will not only entertain, but also give you a deeper understanding of their impact on our financial. In its non-physical form, a credit card represents a payment mechanism which facilitates both consumer and commercial business transactions. Key Takeaways. Credit cards are plastic or metal cards used to pay for items or services using credit. Credit cards charge interest on the money spent. Here are five interesting or little known facts about credit cards you can bring up the next time there's a lull in the conversation. Credit cards have a credit limit that you can make purchases against, then repay at a later date. · Carrying a balance on a credit card can trigger interest.

Credit cards hold more surprises than meets the eye. From their historical evolution to the algorithms governing their numbers, credit cards are more than just. Did you know the credit card companies charge the merchant a fee for each purchase? By paying cash you help the local merchants by increasing their bottom line. Know your rights · Your interest rate on existing balances generally cannot increase unless you're late on your payments · A card issuer cannot take more than credit cards and debit cards. In fact, many merchants stopped accepting cash altogether during the pandemic, and continue to follow such policies. This. Overall, the national average card debt among cardholders with unpaid balances in the fourth quarter of was $6,, down from $6, in the third quarter. The first universal credit card, which could be used at a variety of establishments, was introduced by the Diners' Club, Inc., in Another major card of. You have a credit score, sure, but do you know these odd and interesting facts about credit cards? Ah, the credit card. It's about as ubiquitous as you. Credit cards hold more surprises than meets the eye. From their historical evolution to the algorithms governing their numbers, credit cards are more than just. To be a responsible credit card user, it's important to read all the fine print and understand the numbers and terms on the statement. If you don't, you may end. Affirmation of Facts and Purchase of Account by Debt Buyer Plaintiff [UCS-CCR6] credit card debt only. On November 8, , the Consumer Credit Fairness Act. Myth: Credit Card Fees Don't Affect Business Revenue. Fact: Credit card fees can significantly impact businesses, particularly B2B transactions. Fees range from. A credit card is a payment card, usually issued by a bank, allowing its users to purchase goods or services or withdraw cash on credit. Using the card thus. Here are five interesting or little known facts about credit cards you can bring up the next time there's a lull in the conversation. Fast facts · Credit cards offer access to unsecured credit (no collateral required) · There are many low interest rate cards on the market and over 30 of those. Visibility and insights into consumer spending patterns. Picture of a credit card. Packaged Facts, a leading provider of consumer-oriented market research and. According to the Federal Reserve, the most recent average credit card interest rate is %. APR. At simple interest, with no compounding, then, consumers pay. Living with someone or being in a relationship does not impact your credit scores – and it's against the law for lenders to take a relationship status into. The first universal credit card, which could be used at a variety of establishments, was introduced by the Diners' Club, Inc., in Another major card of. A credit card is not money. It provides an efficient way to obtain credit through a bank or financial institution. Bank account or credit card changes can be made online at skylab-promo.online if you are the plan owner. After logging in, choose the Financial Accounts option.

Where Can I Deposit Cash Into My Chime Account

Dare accepted. You can now deposit cash into your Chime Checking Account fee-free at any of the + Walgreens® stores. Shoutout to Walgreens for. Flexible rent payment options mean you can deposit cash at over 90, retail locations & confirm payment through RentRedi's partnership with Chime. Download. You can add money to your Chime Checking Account by making a fee-free cash deposit5 at any Walgreens location nationwide. And it's not just Walgreens – for a. Check your bank statement to see if the transfer has been processed and deposited into your bank account. Bank transfers aren't deposited on bank holidays or. Icon showing mobile phone direct deposit into account. Direct Deposit · Icon icon of hand with money in it, for add money to card. Add Money · icon of. I deposited $10, to my account. When will the funds be available for withdrawal? If deposited by check, the bank generally must make the first $5, Where can I deposit cash into my Chime Checking Account? · Walmart · 7-Eleven · Speedway · Dollar General · Family Dollar · CVS · Rite Aid · Pilot Travel Centers (Pilot. Setting up direct deposit is the best way to add money to your Chime Account. When you set up direct deposit, you get access to some of. There are two ways to load money on Cash App at Walgreens; — through Paper Money Deposit or through Swipe reload. The Swipe reload method is. Dare accepted. You can now deposit cash into your Chime Checking Account fee-free at any of the + Walgreens® stores. Shoutout to Walgreens for. Flexible rent payment options mean you can deposit cash at over 90, retail locations & confirm payment through RentRedi's partnership with Chime. Download. You can add money to your Chime Checking Account by making a fee-free cash deposit5 at any Walgreens location nationwide. And it's not just Walgreens – for a. Check your bank statement to see if the transfer has been processed and deposited into your bank account. Bank transfers aren't deposited on bank holidays or. Icon showing mobile phone direct deposit into account. Direct Deposit · Icon icon of hand with money in it, for add money to card. Add Money · icon of. I deposited $10, to my account. When will the funds be available for withdrawal? If deposited by check, the bank generally must make the first $5, Where can I deposit cash into my Chime Checking Account? · Walmart · 7-Eleven · Speedway · Dollar General · Family Dollar · CVS · Rite Aid · Pilot Travel Centers (Pilot. Setting up direct deposit is the best way to add money to your Chime Account. When you set up direct deposit, you get access to some of. There are two ways to load money on Cash App at Walgreens; — through Paper Money Deposit or through Swipe reload. The Swipe reload method is.

Use a debit card. load & unload up to $1, for up to $ · Use a barcode from your digital account. Chime, Cash App, PayPal, One & more options available. Conveniently deposit money into your account via bank transfer, cash deposit and other methods. cash deposit location for loading money onto a Chime card. Upvote ·. How much does Dollar General charge you to load money into your chime. Generally, a bank must make the first $ from the deposit available—for either cash withdrawal or check writing purposes—at the start of the next business. Chime has several deposit partners across the country, including Walmart, Dollar General, Walgreens and more. Here's how to load your Chime card at major. If you're asking if you can deposit cash into your Square debit card account, the answer is no. The only way to get funds into that account is through your. cash deposit fees of $ per deposit, and third party processing fees. Deposits into your Current Account over the preceding day period. For. To continue to get money in your Chime account, set up direct deposit from your employer or payroll provider. You can also deposit cash fee-free at any of the. Direct deposit. · Bank transfer initiated through the Chime mobile app or website. · Bank transfers initiated from an external account. · Debit transactions. · Cash. Jan 23, · You can still deposit cash to your Chime account at more If you want to deposit cash into your account, you must do so at one of. Cash deposits to a Chime Checking Account are funds transfers made by third parties (who may impose their own fees or limits) and are FDIC-insured up to. Can I deposit cash into my account? Yes! You can deposit cash into your Chime Checking Account without fees at more than 8, Walgreens and Duane Reade. Capital One. "Account Disclosures." Chime. "How to Deposit Cash Into Your Chime Account." Finovate. "Chime Allows Users To Make Cash Deposits at Walgreens for. Can Someone Send Me Money To My Chime Account? Yes, anyone can send Chime users can deposit cash into their account at over 90, Bring your debit card and cash to a participating merchant like Walmart, CVS, 7-Eleven, Walgreens. Step 2. Tell the clerk you'd like to load cash ($20 minimum). You can deposit cash into your Chime account at retailers like Wal-Mart, 7-Eleven, Walgreens, CVS, Dollar General, etc) (How do I deposit cash in my Chime. And now, Allpoint+ deposit-enabled ATMs help you load cash to participating accounts. As a consumer, you gain access to the Allpoint Network through your. Dare accepted. You can now deposit cash into your Chime Checking Account money from my account. Chime told me they would block them. 2 days later. Simply visit the cashier at a Walgreens or Duane Reade location and ask them to deposit the desired amount into your Chime account. Other. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder.

How To Fix Bad Credit Report

If you have a poor credit score or an error in your credit report, it may affect loans or credit you apply for. You have a right to get errors fixed for. How Do I Fix My Credit for Free? Fixing your credit is something you can do bad credit score. Related Topics: Credit Repair · Aaron Crowe. About Aaron. Repairing bad credit or building credit for the first time takes patience and discipline. negative impact on your FICO Scores. Use payment reminders. A low credit score means you have bad credit. Different companies have How do I fix mistakes in my credit report? Write a letter. Tell the credit. The only and fastest way to rebuild your credit is by paying off any outstanding debt. Also, disputing any error on your credit report and responsibility for. repair a bad credit score. The sooner you know about fraudulent activity, the faster you can report and remove negative items from your credit score. Take a loan out, maybe 5k, and pay it back in installments. This will extend your credit line and show you make payments on time. You can even. Credit ScoreBest Credit Repair Companies. Taxes. +MoreAll TaxesFiling For +MoreAll Help for Low Credit ScoresBest Credit Cards for Bad CreditBest. fix a bad credit score. First, request a copy of your free credit report "Credit Report, How Do I Get a Bankruptcy Removed From My Report?". If you have a poor credit score or an error in your credit report, it may affect loans or credit you apply for. You have a right to get errors fixed for. How Do I Fix My Credit for Free? Fixing your credit is something you can do bad credit score. Related Topics: Credit Repair · Aaron Crowe. About Aaron. Repairing bad credit or building credit for the first time takes patience and discipline. negative impact on your FICO Scores. Use payment reminders. A low credit score means you have bad credit. Different companies have How do I fix mistakes in my credit report? Write a letter. Tell the credit. The only and fastest way to rebuild your credit is by paying off any outstanding debt. Also, disputing any error on your credit report and responsibility for. repair a bad credit score. The sooner you know about fraudulent activity, the faster you can report and remove negative items from your credit score. Take a loan out, maybe 5k, and pay it back in installments. This will extend your credit line and show you make payments on time. You can even. Credit ScoreBest Credit Repair Companies. Taxes. +MoreAll TaxesFiling For +MoreAll Help for Low Credit ScoresBest Credit Cards for Bad CreditBest. fix a bad credit score. First, request a copy of your free credit report "Credit Report, How Do I Get a Bankruptcy Removed From My Report?".

Bad Credit Score? Here's How to Fix it. Having poor credit can be stressful. Especially if you are applying for a mortgage, auto loan or other big purchase. Bad credit could keep you from: · What affects my credit score? · How credit repair works · How long does it take? · Online reviews from our members · How much could. You can fix a bad credit score by paying bills on time, keeping credit card balances low and using credit-strengthening products like secured credit cards. The way to fix this situation is to keep your balances below 75% of your credit card balance. Staying below 50% of your limits will help your score even more. If you see a scam, fraud, or bad business practices, tell the FTC. Go to skylab-promo.online, the FTC's website that makes it easy for you to report. Topics. 5 Steps to Rebuilding Your Credit Score · 1. Identify why you have a credit problem · 2. Create a spending plan · 3. Deal with your debt · 4. Make your payments as. Very Poor VantageScore® Scores: Why fix your credit? Lenders rely on credit scores to assess risk. A low credit score tells a lender that you're more. How will disputes affect your FICO® Score? · It is often thought that closing credit card accounts will improve your score. · Removing negative information from. We are discussing a few reasons for poor credit and how to repair it If you have negative items on your credit report that you can't get removed, you. If you do, file a dispute with the credit reporting company and with the company that was the source of the information. How long does negative information. fix a bad credit score. First, request a copy of your free credit report "Credit Report, How Do I Get a Bankruptcy Removed From My Report?". Paying all your bills on time may be easier said than done. But your payment history is a main driver of your credit scores. And negative information in your. If you want to fix a bad credit score, you have to show lenders you can borrow money and pay it back on time. If you have a poor credit score, you might find. If you have bad credit or no credit at all, secured credit A dispute letter is a way to prompt credit bureaus to remove negative information from your. Your credit score stays with you and there is no reset button so it's important not to ignore a low credit score. There are numerous situations in which a poor. If you've got bad credit, don't get discouraged. We'll help you know your score, understand why it's low, and fix your credit score in 4 simple steps. credit report by phone. Does repair improve my credit score? In many cases, yes. Removing negative items from your report often improves your score. However. I'm worried about the long-term effects on my credit history. What, if anything, can I do to minimize the negative impact? Answer: Going through a bankruptcy is. In other words, to improve bad credit, you need to add positive information to your credit report on a regular basis, so as to basically bury negative records. Six tips help improve your credit Expand · Keep track of your progress. · Always pay bills on time. · Keep credit balances low. · Keep unused accounts open. · Be.

1 2 3 4 5