skylab-promo.online

Tools

Careers To Do From Home

Explore the world of work in British Columbia and discover resources that help people successfully navigate the labour market. A woman works from home on a laptop sitting at a desk. You belong here. Take Work on projects that make a difference and gain experience today that. 16 Remote Jobs Paying $35/hr You Can Do From Home · 1. Business Analyst · 2. Project Manager · 3. Cybersecurity Analyst · 4. Medical Writer · 5. Technical. Your skills, talent, and experience have a home at Workday. See what it's like to be part of our team. Led by our values. Join an inclusive workplace where. Work from home call centre required to promote and find leads for bathroom fitter. Experience, and good industry knowledge required Needs. Home office setup. Co-working allowance. Mental Health Support. Branded swag The team is a core function of our ability to do business and fund growth plans. 30 Companies That Hire for Work-From-Anywhere Jobs · FluentU · Static Media · Kraken · Chainlink Labs · Veeva · Invisible Technologies · Wikimedia Foundation · Finixio. + Real Work from Home Jobs, Gigs, Careers, and Side Hustles that You Can Do Right Now as it's meant to be heard, narrated by Brandon Pollock. Search Canadian jobs, explore careers and labour market trends, subscribe to Whether you're looking for work or new employees, we can help you speed up the. Explore the world of work in British Columbia and discover resources that help people successfully navigate the labour market. A woman works from home on a laptop sitting at a desk. You belong here. Take Work on projects that make a difference and gain experience today that. 16 Remote Jobs Paying $35/hr You Can Do From Home · 1. Business Analyst · 2. Project Manager · 3. Cybersecurity Analyst · 4. Medical Writer · 5. Technical. Your skills, talent, and experience have a home at Workday. See what it's like to be part of our team. Led by our values. Join an inclusive workplace where. Work from home call centre required to promote and find leads for bathroom fitter. Experience, and good industry knowledge required Needs. Home office setup. Co-working allowance. Mental Health Support. Branded swag The team is a core function of our ability to do business and fund growth plans. 30 Companies That Hire for Work-From-Anywhere Jobs · FluentU · Static Media · Kraken · Chainlink Labs · Veeva · Invisible Technologies · Wikimedia Foundation · Finixio. + Real Work from Home Jobs, Gigs, Careers, and Side Hustles that You Can Do Right Now as it's meant to be heard, narrated by Brandon Pollock. Search Canadian jobs, explore careers and labour market trends, subscribe to Whether you're looking for work or new employees, we can help you speed up the.

Find your next job at Google — Careers at Google Work on our innovative software products that have an impact on people's. Careers Home · Why Work for HSN; Career Opportunities. View All Jobs · Health Sciences North Jobs · Medical Staff Jobs · Health Sciences North Research. At Compass, we turn ordinary acts of service into extraordinary moments that make a difference. We bring together the best and brightest people to meet. Remote · Our work model, PinFlex · Love where you work · Grow your career at Pinterest · Principal Machine Learning Engineer, Trust Engineering · Fullstack Engineer. We chose high-paying remote jobs where you can earn at least $35 an hour. They vary a lot. Some require bachelor's degrees, while others accept certifications. skylab-promo.online At Microsoft, we value flexibility as part of our hybrid workplace so that you can feel empowered to do. Read about career information and view open job opportunities at Walmart Canada here. This is that place. + REAL Work from Home Jobs, Gigs, Careers, and Side Hustles that You Can Do RIGHT NOW: Find and Keep a Job You Love Working Remotely - Full-Time. Whether it's helping a vulnerable child, making highways safer or restoring salmon habitat, the work that we do matters to the people of Washington State. Work from home careersView more careers. Salaries. Account Representative salaries in Pompano Beach, FLInsurance Agent salaries in Coeur d'Alene, ID. To do that, we depend on our team of more than 80, talented, ambitious people who share our passion for excellence. Whether you have years of banking. Meta's mission is to give people the power to build community and bring the world closer together. Together, we can help people build stronger communities. + Real WORK FROM HOME Jobs, Gigs, Careers, and Side Hustles that You Can Do RIGHT NOW: Find and Keep a Job You Love Working Remotely Full-Time, Part-Time. Careers with purpose. Careers. with purpose. Join our diverse workforce and enjoy exceptional benefits and a career that grows with your aspirations. Learn. Browse open jobs and land a remote Online Work From Home job today. See detailed job requirements, compensation, duration, employer history. Search Jobs at The Home Depot in our stores, distribution centers, and corporate offices across the country. Explore career opportunities at Discover Financial Services. Browse our roles, apply for jobs and find out how you can build a brighter future. My initial approach was to come home from work, wrap myself in my bedding I would have bursts of energy to do something about my career, followed. Find the most qualified people in the most unexpected places: Hire remote! We Work Remotely is the best place to find and list remote jobs that aren't. Join a Company with Heart. Learn our Purpose, Vision, Company Promise, and Employee Promise. Explore our Benefits, search for jobs, join our Talent.

Best Free Stock Tracker App

What to Look for in the Best Stock Market Apps · Acorns works in a similar way, but it extends even more support by making your investment automatic. · Yahoo! Sharesight logo. Sharesight · (2). Investment portfolio tracking & reporting · Read more about Sharesight ; Similarweb logo · Similarweb · (). Website & app. The 4 Top Portfolio Management Apps · 1. Empower (Formerly Personal Capital) · 2. SigFig Wealth Management · 3. Sharesight · 4. Yahoo! Finance. Finviz is a popular free stock screener app with a focus on technical analysis and visualizations. Traders use Finviz to scan for chart patterns. Free stock market game with real-time trading. Create a custom stock game for your class, club, or friends and learn to invest. Online investment portfolio tracker that syncs with brokers and automatically track stocks, ETFs, dividends, corporate actions, currency changes & more all in. Overview of the best stock market tracking apps and websites · Yahoo Finance: Best for beginners · Morningstar: Best for budget-conscious investors · Seeking Alpha. The Best Free Stock Tracking Spreadsheet you'll find using Google Sheets. Simple and Easy to Use. Get it here and see how it works. Track stocks and equity, funds, ETFs, currencies in the stock market, crypto, and unlisted equity - Real time price alerts to notify you of price changes in. What to Look for in the Best Stock Market Apps · Acorns works in a similar way, but it extends even more support by making your investment automatic. · Yahoo! Sharesight logo. Sharesight · (2). Investment portfolio tracking & reporting · Read more about Sharesight ; Similarweb logo · Similarweb · (). Website & app. The 4 Top Portfolio Management Apps · 1. Empower (Formerly Personal Capital) · 2. SigFig Wealth Management · 3. Sharesight · 4. Yahoo! Finance. Finviz is a popular free stock screener app with a focus on technical analysis and visualizations. Traders use Finviz to scan for chart patterns. Free stock market game with real-time trading. Create a custom stock game for your class, club, or friends and learn to invest. Online investment portfolio tracker that syncs with brokers and automatically track stocks, ETFs, dividends, corporate actions, currency changes & more all in. Overview of the best stock market tracking apps and websites · Yahoo Finance: Best for beginners · Morningstar: Best for budget-conscious investors · Seeking Alpha. The Best Free Stock Tracking Spreadsheet you'll find using Google Sheets. Simple and Easy to Use. Get it here and see how it works. Track stocks and equity, funds, ETFs, currencies in the stock market, crypto, and unlisted equity - Real time price alerts to notify you of price changes in.

The best stock tracker on the market Delta is the ultimate stock & equity tracker app. Keep track of all stocks spanning global markets such as Nasdaq, NYSE. Like Yahoo Finance, MarketWatch draws a lot of traffic from site visitors. The Dow Jones-owned site also manages to add a few nifty features to its free tracker. TradingView is the winner of the best Android stock app because it has the best charts, the biggest community, covers all global markets, and is free. Keep track of all your stocks, real estate and commodities. Analyse any stock with relevant data. Everything in real-time and % free to use. 8 best stock tracking apps · 1. Empower · 2. Seeking Alpha · 3. Robinhood · 4. Morningstar · 5. Stock Rover · 6. E*TRADE · 7. SigFig Portfolio Tracker · 8. M1. Discovered this app by accident as I was looking for trading journal for risk management purposes: Simple Portfolio offers performance overview and. Download for free. It's time to level up your investment game. Download This is the best and easiest digital investment tracking app I've ever used. 1> Robinhood: Known for its user-friendly interface and commission-free trading, Robinhood also offers real-time market data and customizable. Stock tracker to help you track stocks, crypto, forex, and more. Track stocks with stock alerts through phone calls, text messages, emails. Sharesight, a popular investment portfolio tracker, is used in more than countries around the world. It tracks all your stocks, ETFs and dividends in one. The free version of Yahoo finance should do all of this. Looking at mine, with multiple portfolios, I see a graph over time for today, 1day, 1 week 1Y, All. Empower – Best Free Investment Management App · Simplifi by Quicken – Best Investment Management App for Beginning Investors · Quicken Classic Premier – Best. A trader's rite of passage, charts power insight. Millions use ours – for free – to make better decisions in the markets. Our charts work on any device and. Best Free Stock Portfolio Management Software · Sharesight · Similarweb · Dolibarr · Seeking Alpha · PYTHEOS · TOGGLE · Active Trader Pro · Simpliza. SigFig is an excellent portfolio tracker for those looking to take control of their finances and make intelligent investments. This best stock-tracking app. What brokerage account can Weathica track? · Questrade: Overall Best Trading App. · Wealthsimple Trade: Best Free Trading App. · Qtrade: Best Trading App for. Track your personal stock portfolios and watch lists, and automatically determine your day gain and total gain at Yahoo Finance. Features: • Stock charts from Nasdaq, NYSE, Euronext, and many more for free. Resize and place your widgets where you want, on any monitor. Change the font. Our free inventory tracking app makes managing inventory and monitoring stock levels much easier. Download now. Here are some of the best free stock trading apps that can help you track the ups and downs of the market.

Budgeting Apps For Young Adults

These apps help build healthy habits for saving and investing. The earlier children understand the relationship between spending and saving, the more. Visual Budget is a budget-planning app that allows users to easily track their budget and spending on a monthly basis. The app is designed for adults and. Mint Has Shut Down: Here Are the 5 Best Free Budgeting Apps to Use Instead · 1. Expense Tracking: SoFi Insights · 2. Debt Deletion: Debt Payoff Planner · 3. Budget. Budgeting for teens can be a helpful way to develop responsible money habits and plan for the future. Learn some tips on how your teen can budget their. Simplifi is a budgeting app offered by money management platform Quicken. The app is ad-free and offers budgeting services to over 20 million members. Simplifi. Top 10 Budgeting Apps for Teens · Expense Manger · Money · skylab-promo.online · Koku · Money Wise · Coin Keeper · Spending Tracker. My Weekly Budget. I love Empower. Also, for budgeting, I use Empower to get all of my transactions in one place, then export to my own budget spreadsheet! Mint: Mint is a popular and free app that helps you track your spending, create budgets, and manage your overall financial picture. It syncs. You Need a Budget is a strong choice if you want to use a detailed and hands-on budgeting app to monitor expenses. These apps help build healthy habits for saving and investing. The earlier children understand the relationship between spending and saving, the more. Visual Budget is a budget-planning app that allows users to easily track their budget and spending on a monthly basis. The app is designed for adults and. Mint Has Shut Down: Here Are the 5 Best Free Budgeting Apps to Use Instead · 1. Expense Tracking: SoFi Insights · 2. Debt Deletion: Debt Payoff Planner · 3. Budget. Budgeting for teens can be a helpful way to develop responsible money habits and plan for the future. Learn some tips on how your teen can budget their. Simplifi is a budgeting app offered by money management platform Quicken. The app is ad-free and offers budgeting services to over 20 million members. Simplifi. Top 10 Budgeting Apps for Teens · Expense Manger · Money · skylab-promo.online · Koku · Money Wise · Coin Keeper · Spending Tracker. My Weekly Budget. I love Empower. Also, for budgeting, I use Empower to get all of my transactions in one place, then export to my own budget spreadsheet! Mint: Mint is a popular and free app that helps you track your spending, create budgets, and manage your overall financial picture. It syncs. You Need a Budget is a strong choice if you want to use a detailed and hands-on budgeting app to monitor expenses.

With over half a million positive reviews on the iTunes app store, it's one of the most popular options for people looking to increase their financial health. We've spent hundreds of hours determining the best apps, tools, credit cards, insurance, and more for you to get the most out of your money. financial capable young adults. Mobile Bill Pay Companion App (iOS/Android) Cash Flow Budgeting. Another innovation that you can only find here is Cash. Best money apps for college students · For learning how to budget: Goodbudget · For getting started with investing: Acorns · For saving money: Digit · For cash. EveryDollar is a straightforward, easy-to-use budgeting app that allows users to create a customizable budget and set savings goals. Users can opt to upgrade to. You Need a Budget is a strong choice if you want to use a detailed and hands-on budgeting app to monitor expenses. Goodbudget is an app that uses the envelope system for budgeting. With this system, you create various digital envelopes — you might have one for groceries, one. If you're serious about budgeting apps, YNAB is a top choice thanks to its detailed budgeting strategy, excellent support, and helpful features. Dinner Table is the best budgeting app for both kids & adults Dinner Table is an educational app for financial literacy because it's designed to help young. One of the best online money management apps out there, Empower is a free tool that allows you to create a budget, track your spending, and save. Connect all of. We've put together a list of the most helpful money management apps for your convenience. If you try one and it doesn't gel, feel free to switch to another. We recommend three apps above all others: Simplifi, which is best for most people, Quicken Classic if you want to manage your money in more detail, and YNAB. Goodbudget is a personal finance app perfect for budget planning, debt tracking, and money management. Share your budget and data across multiple phones (and. Keeping track of your day to day spending isn't easy, and it's not uncommon to find yourself declined once in a while when using a card. Budgeting apps have. Mint: Mint is a popular and free app that helps you track your spending, create budgets, and manage your overall financial picture. It syncs. 6 Brilliant budgeting apps for students · Squirrel iOS / Android · Wally iOS · Splitwise iOS / Android · My Supermarket iOS / Android · Chip iOS / Android. Check these budgeting apps for young adults and save money every month. Once you find the right budgeting tools you'll see a significant. The money apps for teens below are better than cash or credit cards. Money apps can address multiple financial needs and accomplish several goals. One of the best ways to keep track of your money is to use a budget planner app. Creating a budget helps you allocate money for textbooks and regular expenses. Best budgeting apps for managing your money · Our pick: Empower · Best for planning ahead: You Need a Budget (YNAB) · Best for scheduling and forecasting.

Webull Free Stock Review

As the title indicates, I really like WeBull because it allows access to the market the earliest of any trading applications out there (AM EDT). I always. What makes Webull great? · Commission-free stock & ETF trading · Completely free options trades · Trade crypto 24/7 · Level 2 options trading · Live market data. Truly Commission Free Trading. • Pay $0 in commissions to trade stocks, options and ETFs. Pay $0 for options contract fees. No minimum deposit requirement. But like to see both the same. I also love the IPO and SPAC section, that inform you of up coming companies. They also have built-in Stock Screener, that is. Stocks and US ETFs 3-year commission-free* SG Stock Trading. · ·. Low Options trading functionality is subject to Webull Securities' review and approval. Webull is in fact a zero-commission broker when it comes to buying and selling stocks. Zero commission is especially useful if you trade relatively low. Free trading of stocks, ETFs, and options refers to $0 commissions for Webull Financial LLC self-directed individual cash or margin brokerage accounts and IRAs. The free stock will be between $8 and $ Remember, you must fund your account within 30 days. The more friends you refer, the higher your chance of getting. Webull is an online discount broker, best suited to stock and ETF traders who rely on technical analysis, offering great charting tools and advanced trading. As the title indicates, I really like WeBull because it allows access to the market the earliest of any trading applications out there (AM EDT). I always. What makes Webull great? · Commission-free stock & ETF trading · Completely free options trades · Trade crypto 24/7 · Level 2 options trading · Live market data. Truly Commission Free Trading. • Pay $0 in commissions to trade stocks, options and ETFs. Pay $0 for options contract fees. No minimum deposit requirement. But like to see both the same. I also love the IPO and SPAC section, that inform you of up coming companies. They also have built-in Stock Screener, that is. Stocks and US ETFs 3-year commission-free* SG Stock Trading. · ·. Low Options trading functionality is subject to Webull Securities' review and approval. Webull is in fact a zero-commission broker when it comes to buying and selling stocks. Zero commission is especially useful if you trade relatively low. Free trading of stocks, ETFs, and options refers to $0 commissions for Webull Financial LLC self-directed individual cash or margin brokerage accounts and IRAs. The free stock will be between $8 and $ Remember, you must fund your account within 30 days. The more friends you refer, the higher your chance of getting. Webull is an online discount broker, best suited to stock and ETF traders who rely on technical analysis, offering great charting tools and advanced trading.

Free trading of stocks, ETFs, and options refers to $0 commissions for Webull Financial LLC self-directed individual cash or margin brokerage accounts and. Webull is a commission-free online brokerage and stock trading app for novice and experienced investors. Webull is similar to Robinhood in that if you use someone's referral link to open a new account with them, they get a free stock. CLICK HERE to get a free stock. Webull is simply an investment app on which traders can purchase and sell stocks and ETFs. Webull offers free stock trading services free of commission or any. To get free stock from Webull, you need to make an initial deposit of $ or more and maintain the funds for 30 days. Q. Can I withdraw my free stock from. For a platform that offers free commissions, Webull has decent technical tools that will satisfy the majority of traders. Their charts are high quality and. As the title indicates, I really like WeBull because it allows access to the market the earliest of any trading applications out there (AM EDT). I always. Zero-commission stock trading: % commission-free trading and zero minimum deposit requirements · Mobile and web-based desktop: · Stock trading simulator. Webull - Commission-Free Stock Trading App: Get Free Stocks with New Account ($3-$ Each). Referral Bonuses. 5% APY on Cash. Claim your profile to access Trustpilot's free business tools and connect with customers. Webull offers online stock trading, real time market quotes. What is the average value for Webull's free stock offer? Expect to receive fractional shares of stock valued at $3. So, if you deposit $, expect to receive. There is no minimum account size, the margin rates are competitive, and there are zero commissions on stocks, ETFs, futures, and options. Moreover, you get. Free trading of stocks, ETFs, and options refers to $0 commissions for Webull Financial LLC self-directed individual cash or margin brokerage accounts and IRAs. Plus, Webull has one of the best free stock trading apps. Keep an eye out for Webull to bring these promotions back. And despite Webull's focus on active. Currently, Webull users can get a bonus of five free stocks when they open and fund a new account: Sign up with Webull to get your two free stocks, each valued. Webull is a new commission-free stock trading app that makes it easy (and affordable) to buy and sell stocks online. Plus, Webull has one of the best free stock trading apps. Keep an eye out for Webull to bring these promotions back. And despite Webull's focus on active. Pros · Zero-commission stock, ETF, options, with no options contract fees · User-friendly mobile app with advanced trading tools · Free desktop trading platform. Webull is a solid broker choice for investors who are looking for a low-cost mobile trading platform. While not as well known as rival Robinhood, Webull's.

Mortgage Broker Percentage

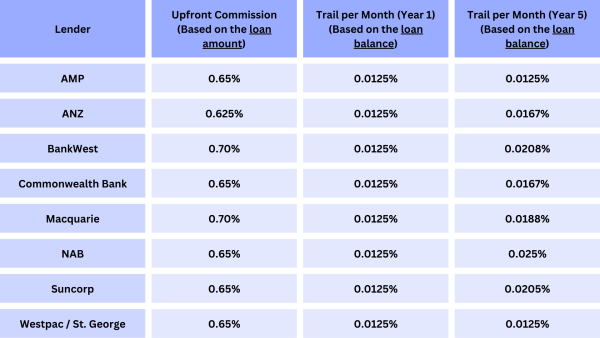

The lender fee is a fee that the lender pays to the broker. Lenders usually set aside a certain percentage of the loan amount, typically around % - In this article, we explore the ins and outs of working with using a mortgage broker and what you need to know about associated fees. They typically earn a commission of around 1%-2% of the loan value, which the borrower or the lender can pay. When you take out a larger loan. The mortgage lender will give a commission of around percent of the full loan size after the mortgage is completed by the adviser on behalf of their client. By signing below, you request us to arrange a mortgage loan from a. Mortgage Lender and you agree to the Broker Fees listed below for our services. Our services. With the average mortgage broker commission being between % and % of the mortgage amount, the average mortgage broker would bring in between $ and. Call lenders and mortgage brokers and ask about interest rates and fees for the size loan you need. Be sure to ask: • What types of loans are available? • What. The Bottom Line. Mortgage broker fees are the charges for the services provided by a mortgage broker. The cost of these fees can vary but is usually within the. Their payment is called a “loan origination fee” - usually 1% of the mortgage amount and due at closing. It is possible to find brokers who will allow you to. The lender fee is a fee that the lender pays to the broker. Lenders usually set aside a certain percentage of the loan amount, typically around % - In this article, we explore the ins and outs of working with using a mortgage broker and what you need to know about associated fees. They typically earn a commission of around 1%-2% of the loan value, which the borrower or the lender can pay. When you take out a larger loan. The mortgage lender will give a commission of around percent of the full loan size after the mortgage is completed by the adviser on behalf of their client. By signing below, you request us to arrange a mortgage loan from a. Mortgage Lender and you agree to the Broker Fees listed below for our services. Our services. With the average mortgage broker commission being between % and % of the mortgage amount, the average mortgage broker would bring in between $ and. Call lenders and mortgage brokers and ask about interest rates and fees for the size loan you need. Be sure to ask: • What types of loans are available? • What. The Bottom Line. Mortgage broker fees are the charges for the services provided by a mortgage broker. The cost of these fees can vary but is usually within the. Their payment is called a “loan origination fee” - usually 1% of the mortgage amount and due at closing. It is possible to find brokers who will allow you to.

Mortgage brokers are compensated only when they close a loan—this makes the model a no-risk proposition for lending institutions. The lender fee is a fee that the lender pays to the broker. Lenders usually set aside a certain percentage of the loan amount, typically around % - Read the Mortgage Broker Fee Agreement carefully so that you can make an informed choice. You are entitled to a copy of this contract. In the following disclosure, I=applicant; you=mortgage broker. You have advised me that you are authorized and prepared to assist me in securing financing. I. It can be anywhere between 2%-3% of the loan amount you borrow from the lender. Typically this is in the disclosure statement that the broker. Most loan officers work off % commission! Let's look at how the loan officer and the mortgage company make their money. If you work with a mortgage broker, the industry norm is for them to charge you an origination fee equal to 1 percent of the loan amount. You asked about the treatment of mortgage broker fees under the. Colorado Uniform Consumer Credit Code ("UCCC"), specifically whether such fees may be. First mortgages – 5 percent of the principal for loans of less than 2 years; 5 percent for loans of more than 2 years but less than 3; 10 percent for loans of 3. Typically, the commission is 1% to 2% of the loan sum. A mortgage broker may be paid by the buyer or the lender, but not both. Currently, the average mortgage. While these fees can vary from lender to lender, by law, they cannot exceed 3% of the total loan amount. Third party fees are charged on nearly all loans. These. The costs vary greatly but a mortgage broker generally earns between 1% and 3% of the total loan amount. The total amount paid by the borrower will vary based. While these fees can vary from lender to lender, by law, they cannot exceed 3% of the total loan amount. Third party fees are charged on nearly all loans. These. A mortgage broker's commission varies depending on the lender. However, their pay typically ranges from percent to percent of the loan principal. This is typically a percentage varying anywhere between 40 to 80 percent of the loan income. Percentages can vary for many reasons. The various reasons to vary. Mortgage Broker gender ratio over time This data breaks down the percentage of men and women in mortgage broker positions over time. Currently, % of. Commissions are still determined by how big the loan is, but the percentage a broker earns tends to be around to %.Your mortgage broker must declare. Mortgage brokers in Canada are paid by the lender and do not charge fees for good credit applications. In the US, many mortgage brokers are regulated by their. A loan origination fee may not be paid except pursuant to a written mortgage broker agreement between the mortgage broker and the borrower.

How To Buy Stocks From Home

Yes, you can trade stocks from home. Today, with the Internet and most brokers having online websites and tools, you can simply create an account at an online. Instead of trading shares based on stock market timing, investors buy stocks and hold onto them despite any market fluctuation. Active investing relies on real-. Looking to trade stocks online? Fidelity offers unlimited trades and low commissions with its stock trading account. Learn more here. Many discount brokers let you do your trading through the Internet, so you can track your stocks and issue transaction orders , without speaking to anyone. To buy stocks, you'll typically need the assistance of a stockbroker since you cannot simply call up a stock exchange and ask to buy stocks directly. Invest in stocks listed on major North American exchanges or pick from stocks sold over-the-counter in Canada and the U.S.. Stock features. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. Step-by-step guide · 1. Select the account you want to trade in. · 2. Enter the trading symbol. · 3. Select Buy or Sell. · 4. Choose between Dollars and Shares. ETRADE from Morgan Stanley Home page · Log on. Open search search. How to trade How to trade stocks. Your guide to placing your first stock order. Do. Yes, you can trade stocks from home. Today, with the Internet and most brokers having online websites and tools, you can simply create an account at an online. Instead of trading shares based on stock market timing, investors buy stocks and hold onto them despite any market fluctuation. Active investing relies on real-. Looking to trade stocks online? Fidelity offers unlimited trades and low commissions with its stock trading account. Learn more here. Many discount brokers let you do your trading through the Internet, so you can track your stocks and issue transaction orders , without speaking to anyone. To buy stocks, you'll typically need the assistance of a stockbroker since you cannot simply call up a stock exchange and ask to buy stocks directly. Invest in stocks listed on major North American exchanges or pick from stocks sold over-the-counter in Canada and the U.S.. Stock features. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. Step-by-step guide · 1. Select the account you want to trade in. · 2. Enter the trading symbol. · 3. Select Buy or Sell. · 4. Choose between Dollars and Shares. ETRADE from Morgan Stanley Home page · Log on. Open search search. How to trade How to trade stocks. Your guide to placing your first stock order. Do.

Start investing online with SoFi. Enjoy commission-free trades and access to stock trading, options, auto investing, IRAs, and more. Start with just $5. $0 online equity trade commissions + Satisfaction Guarantee. See our pricing Investing Basics: Stocks. Stocks are one of the most common investments. We spent hours comparing more than a dozen stock trading platforms looking for the most intuitive tools, in-depth research and access to guidance and other. Learn how to buy and sell stocks with E*TRADE. We'll give you the education, analysis, guidance, and tools you need to find stocks that are right for you. There is an app called Robinhood that allows for commission-free trades. This is the least expensive and most immediate way to invest in the. Looking to trade stocks online? Fidelity offers unlimited trades and low commissions with its stock trading account. Learn more here. Buying stocks without a broker is possible through online brokerage accounts, dividend reinvestment plans, and direct stock purchase plans. How to invest in stocks Stock trading for beginners involves considering your overall investment aims and your reasons for investing. Your risk-profile will. You can invest in the common stock of The Home Depot, Inc. through many financial institutions such as full-service brokers, discount brokers and online brokers. If you watch channels like Fox Business or CNBC, they also provide good coverage on stock opinions and how the overall market is doing. I would recommend to. Tap the Investing tab on your Cash App home screen · Tap the search bar and enter a company name or ticker symbol · Select the company whose stock you want to buy. Define Your Goals and Strategies · Want to buy and sell stocks online? · Research the companies you want to invest in · Obtain a Quote · Place the Trade · Things to. Trade your favorite stocks anytime. The 24 Hour Market is here. Trade TSLA Robinhood Wallet is your self-custody home for crypto, NFTs, dapps, and more. Understanding how stocks work is the first step in using them to reach your goals. Home How to buy stocks. You can buy or sell stocks by opening a brokerage. SLIDE iNTO. THE STOCK. MARKET · Investing** is simple, whether you're new to it or already have a portfolio · Tiptoe or dive right in · Cash App doesn't take a cut. The most common way to purchase individual stocks is through a brokerage account. A Financial Advisor can help you select stocks. Investors in the EU can trade Samsung Electronics GDRs the same way they trade stocks listed on their local stock exchanges. Residents of other regions. Non-EU. Once you've determined how much you'd like to invest in the stock market, you can research what stocks you'd like to buy. There are three main types of stocks. Buying Direct · Direct Stock Purchase Plan (DSPP): A DSPP allows you buy shares directly through the company. · Dividend Reinvestment Plan (DRIP): DRIPs. The most common way to buy and sell shares is by using an online broking service or a full service broker.

Define Pre Approved Mortgage

A pre-approval letter is a document from a lender that is based on the financial information you gave them. This letter does not make a promise. Instead, it. The letter is issued by a lender or a mortgage broker and is used to instill confidence in a seller because it verifies that the buyer can obtain the funds. A preapproval letter is a statement from a lender that they are tentatively willing to lend money to you, up to a certain loan amount. A preapproval letter is. Getting prequalified is a quick and simple way to find out how Seeing the loan amount, interest rate, and monthly payment you could qualify for means. What is Pre Approval. A mortgage pre-approval is when a potential mortgage lender looks at your finances to find out the amount and interest rate they will. A pre-approval will give you an idea of the loan amount that you can afford. Get a mortgage pre-approval prior to selecting a particular property. What pre-approval means. You have reached out to a mortgage lender ahead of making an offer on a home. You have completed a mortgage loan application. Pre-qualification is an informal way for a lender to review your financial information and estimate how much you may be able to borrow. You can be “pre-. A pre-approved mortgage means a lender has reviewed your financial history and determined you may qualify for a loan up to a certain amount. A pre-approval letter is a document from a lender that is based on the financial information you gave them. This letter does not make a promise. Instead, it. The letter is issued by a lender or a mortgage broker and is used to instill confidence in a seller because it verifies that the buyer can obtain the funds. A preapproval letter is a statement from a lender that they are tentatively willing to lend money to you, up to a certain loan amount. A preapproval letter is. Getting prequalified is a quick and simple way to find out how Seeing the loan amount, interest rate, and monthly payment you could qualify for means. What is Pre Approval. A mortgage pre-approval is when a potential mortgage lender looks at your finances to find out the amount and interest rate they will. A pre-approval will give you an idea of the loan amount that you can afford. Get a mortgage pre-approval prior to selecting a particular property. What pre-approval means. You have reached out to a mortgage lender ahead of making an offer on a home. You have completed a mortgage loan application. Pre-qualification is an informal way for a lender to review your financial information and estimate how much you may be able to borrow. You can be “pre-. A pre-approved mortgage means a lender has reviewed your financial history and determined you may qualify for a loan up to a certain amount.

What Is a Mortgage Pre-Qualification? Mortgage pre-qualification means a lender is willing to provide you a certain amount of money to purchase a home. Pre-. The approval is the process of obtaining a specific loan on a specific property for a specific amount. These are subject to review of a complete loan. What is a mortgage pre-approval? Mortgage pre-approval is a process that allows you to: Lenders set the terms and criteria for each step. During this. The meaning of PREAPPROVE is to approve (something or someone) in advance. How to use preapprove in a sentence. Mortgage pre-approval requires a buyer to complete a mortgage application and provide proof of assets, confirmation of income, good credit, employment. What Is Pre-Approval? A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. What Is Pre-Approval? Pre-approval is a process where we assess your financial situation to determine how much you can borrow. This is an essential step in. What Is Pre-Approval? A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. A pre-approved mortgage is a tentative promise from a lender that it will loan you a certain amount of money for the purchase of real estate. The pre-approval meeting is the time to find out about different mortgage products that are available to suit your particular needs. Once the mortgage is pre-. What is a pre-qualified offer? Pre-qualification is an early step in the home or car buying process during which the borrower submits financial data for the. In lending, a pre-approval is the pre-qualification for a loan or mortgage of a certain value range. For a general loan a lender, via public or proprietary. Budget Clarity: A pre-approved home loan gives you a clear understanding of the loan amount you are eligible for, helping you set a realistic. What is mortgage preapproval? A mortgage preapproval letter is a document from a lender conditionally offering you a mortgage. It contains the loan terms —. Pre-approval comes later and is far more complex than pre-qualification. To get pre-approved, the borrower must complete a mortgage application and provide the. Remember, a pre-approval doesn't lock you into a specific lender, but it does offer you insights into potential mortgage payments and enhances your buying power. What is a mortgage pre-approval? A mortgage pre-approval is an estimate of how much of a mortgage lender would be willing to lend a homebuyer (the borrower). A. PRE-APPROVED meaning: 1. accepted, allowed, or officially A pre-approved mortgage puts your financing in place before you make an offer on a home. Basically, becoming pre-approved for a loan means you have undergone further vetting and are confirmed to be approved for a mortgage of a certain type, value. A pre-approval means you have been approved for a certain mortgage amount after a lender has gone through your finances, credit score, and a few other things. A.

How To Trade With Volume

Compared with the more well-known volume-by-time indicator, which is the measure of trading activity over a specific period of time, the volume profile provides. As volume decreases in the expiring contract, trading will shift to the next available month contract. For example, say the June ES (E-mini S&P ) futures. Firstly, volume can help you confirm chart patterns and price trends, as it indicates how much interest the instrument is getting. In general, higher volume. Traders often observe volume trends to guide trading strategies and make important decisions. Staying abreast of volume patterns enables traders. Trading volume is a valuable tool in evaluating the strength or weakness of a stock at any given time. It offers information about and can assist in confirming. Order Book Trading. How to Trade Using the Order Book. 14/08/ /in Volume Analysis. Volume-based trading includes analysing and using the raw volume data to execute a trade. You can conduct volume trading by using volume data or volume-based. Tracking trading volume can be quite useful for technical analysts and traders. Learn more about the basics. Volume is the total amount of shares exchanged that is both buying + selling, the net is always zero. Compared with the more well-known volume-by-time indicator, which is the measure of trading activity over a specific period of time, the volume profile provides. As volume decreases in the expiring contract, trading will shift to the next available month contract. For example, say the June ES (E-mini S&P ) futures. Firstly, volume can help you confirm chart patterns and price trends, as it indicates how much interest the instrument is getting. In general, higher volume. Traders often observe volume trends to guide trading strategies and make important decisions. Staying abreast of volume patterns enables traders. Trading volume is a valuable tool in evaluating the strength or weakness of a stock at any given time. It offers information about and can assist in confirming. Order Book Trading. How to Trade Using the Order Book. 14/08/ /in Volume Analysis. Volume-based trading includes analysing and using the raw volume data to execute a trade. You can conduct volume trading by using volume data or volume-based. Tracking trading volume can be quite useful for technical analysts and traders. Learn more about the basics. Volume is the total amount of shares exchanged that is both buying + selling, the net is always zero.

Trading volume is the number of shares of a certain stock that is traded over a given period. It is not calculated but rather counted and subsequently reported. In the context of a single stock trading on a stock exchange, the volume is commonly reported as the number of shares that changed hands during a given day. The. The volume of trade is the total number of contracts or shares exchanged for a particular security. Every market exchange keeps tabs on its trade volume and. The indicator can alert traders of market activity, sentiment, and trading activity in a specific asset. It's important to note volume meaning in regards to. Volume trading in forex is all about trading currency pairs with high buying or selling pressure. Trading volume. Browse Terms By Number or Letter: The number of shares transacted every day. As there is a seller for every buyer, one can think of the. One crucial metric they utilise while understanding how to use volume in trading is referring to the number of shares traded within a specific time frame. The Trade Volume Index (TVI) leverages intraday market data to show whether a security is being accumulated (purchased) or distributed (sold). The Trade Volume. Not long ago, decentralization of the FX market hindered real time access to global trade volumes. Things have changed The Value of trading volume in FX: a. Volume Profile works well here because they (price & volume) are both on the Y (vertical) axis. A pullback to the POC (or other high volume node). Volume of trade, also known as trading volume, refers to the quantity of shares or contracts that belong to a given security traded on a daily basis. Volume in forex is the number of lots traded in a currency pair within a certain time period. In other words, the amount of currency bought and sold. Volume on. Volume is the number of shares that trade on any given day. The higher the volume, the better. For example, if MSFT trades, on average, 10 million shares. Volume profile is a powerful analysis visualization that reflects the number of contracts that have traded at a certain price or price range. This analysis can. Learn how trading volume affects market trends, price movements, and potential opportunities. Read on to know more. It's worth noting that, for a wide range of other chart patterns, volume is essential. For instance, 2 technical trading patterns that incorporate volume. High volume is important while trading forex because it signals that more and more traders are willing to buy and sell the currency pair in the market. Volume analysis is defined as the number of trade exchanges such as shares and contracts during a specific time period. Volume Availability. Off-exchange share of market volume in low-priced stocks is generally higher than the overall market average, and that trend has.

Place In The 4ps Of Marketing

Place is often referred to as the distribution channel or physical location of where a product is available. Put simply, it represents the way a. Explaining The 4Ps of Marketing (Product, Price, Place, Promotion) · Price is the amount a customer pays for a product or service · Place refers to the channels. The marketing mix, also known as the four P's of marketing, refers to the four key elements of a marketing strategy: product, price, place and promotion. The 4 Ps of marketing: By starting with these you'll be able to keep your business in front of your customers and build a sustainable business through these. The 4 Ps are the key factors in marketing a product or service to consumers: product, price, place, and promotion. They are also known as a marketing mix. The 4 Ps of Marketing, introduced by E. Jerome McCarthy in , stand for Product, Price, Place, and Promotion. These elements are essential for effective. What are the 4 Ps of marketing? · 1. Product · 2. Price · 3. Place · 4. Promotion. The article covers the original concept of the 4 P's of Marketing Mix - Product, Place, Price, and Promotion - with an example and template for your. An effective marketing strategy combines the 4 Ps of the marketing mix. It is designed to meet the company's marketing objectives by providing its customers. Place is often referred to as the distribution channel or physical location of where a product is available. Put simply, it represents the way a. Explaining The 4Ps of Marketing (Product, Price, Place, Promotion) · Price is the amount a customer pays for a product or service · Place refers to the channels. The marketing mix, also known as the four P's of marketing, refers to the four key elements of a marketing strategy: product, price, place and promotion. The 4 Ps of marketing: By starting with these you'll be able to keep your business in front of your customers and build a sustainable business through these. The 4 Ps are the key factors in marketing a product or service to consumers: product, price, place, and promotion. They are also known as a marketing mix. The 4 Ps of Marketing, introduced by E. Jerome McCarthy in , stand for Product, Price, Place, and Promotion. These elements are essential for effective. What are the 4 Ps of marketing? · 1. Product · 2. Price · 3. Place · 4. Promotion. The article covers the original concept of the 4 P's of Marketing Mix - Product, Place, Price, and Promotion - with an example and template for your. An effective marketing strategy combines the 4 Ps of the marketing mix. It is designed to meet the company's marketing objectives by providing its customers.

The 4 Ps of marketing are the four important pillars of marketing strategy that all marketing professionals should know. These are Promotion, Product, Place. Marketing mix: the 8 facets of the P of “Place” · Distribution strategy · Franchising · Market coverage · Selection and relationship with distribution partners. Product, Price, Place and Promotion. We look at the 4 pillars of any good marketing strategy to help kick-start your strategic thinking and marketing. The “classic” 4 P's of Marketing – Price, Product, Promotion, and Place – were introduced in and had a long, virtuous run. However, Sean MacDonald, Chief. The 4Ps of marketing is a model for enhancing the components of your marketing mix – the way in which you take a new product or service to market. The 4 Ps of marketing are product (what you sell), price (how much you sell it for), place (where you sell and promote it), and promotion (how you promote it). The marketing four Ps are product, price, place, and promotion. They are the key factors involved in marketing a product or service. In the marketing mix, the process of moving products from the producer to the intended user is called place. In other words, it is how your product is bought. Product should be considered the most important of their 4 Ps. If your product is in high demand, you won't need to spend much on promotion. The 4 Ps – product, price, place and promotion – are vital elements for successful marketing. Learn how to uncover the secrets to your marketing mix. Marketing Mix · 1. Product · 2. Price · 3. Promotion · 4. Place (or Distribution). The four primary elements of a marketing mix are product, price, placement, and promotion. This framework aims to create a comprehensive plan to distinguish a. The 4 P's of marketing are product, price, place, and promotion. Why are the 4 P's of marketing so relevant to a business? The 4 P's of marketing, also known as. Learn how to use the marketing mix (often called the 4Ps of marketing) to get the right combination of place, price, promotion, and product for your business. Place · ✓ Strategy - Intensive Selection vs. Exclusive Distribution · ✓ Franchise Opportunities · ✓ Market Coverage · ✓ Channel Member Selection or Relations · ✓. The “4 Ps of marketing” may sound like blah business jargon to restaurant types, but these four principles—product, price, place, and promotion—can. Take, for example, the traditional 4Ps of marketing: Product, Price, Place (distribution) & Promotion. It's an old-school notion that's just as applicable today. Place strategy is a strategic part of the marketing mix that deals with how a company should sell its services or products. Also referred to as the marketing mix, the four Ps of marketing are product, price, place, and promotion. The 4 Ps of the marketing mix are important. The 4Ps of marketing, also known as the marketing mix, are a set of key elements that collectively form the foundation of a marketing.

Do Prepaid Cards Build Your Credit

Prepaid credit cards will NOT help boost your credit score. They're basically glorified gift cards. Once the funds expire, you can reload it. A useful tool for rebuilding your credit If you have bad credit, simply relying on cash, prepaid cards or debit cards to make your purchases will do nothing. While using a debit card responsibly can help you manage your finances, it will not help you build credit or improve your credit score. Having a. Impact on your credit score may vary depending on your use. Extra is required to report both on time and late payments. How Does the Extra Card Work? We monitor your activity and regularly report your card status to the three major credit bureaus. Spend within your limit and pay your bill when it's due. Over. No, prepaid credit cards are not linked to a line of credit and don't report activity to the credit bureaus, so they do not help build credit history. Are. A prepaid card can be an incredibly useful alternative to a conventional card—especially if you're up against a less-than-ideal credit rating or need a payment. Prepaid cards do not have an impact on your credit score because when you spend on them, you are not borrowing money. Any money you borrow — be it a credit card. How can a Prepaid Card Improve my Credit Rating? A prepaid card is not based on credit, which means you don't need to have a good credit history to get one. Prepaid credit cards will NOT help boost your credit score. They're basically glorified gift cards. Once the funds expire, you can reload it. A useful tool for rebuilding your credit If you have bad credit, simply relying on cash, prepaid cards or debit cards to make your purchases will do nothing. While using a debit card responsibly can help you manage your finances, it will not help you build credit or improve your credit score. Having a. Impact on your credit score may vary depending on your use. Extra is required to report both on time and late payments. How Does the Extra Card Work? We monitor your activity and regularly report your card status to the three major credit bureaus. Spend within your limit and pay your bill when it's due. Over. No, prepaid credit cards are not linked to a line of credit and don't report activity to the credit bureaus, so they do not help build credit history. Are. A prepaid card can be an incredibly useful alternative to a conventional card—especially if you're up against a less-than-ideal credit rating or need a payment. Prepaid cards do not have an impact on your credit score because when you spend on them, you are not borrowing money. Any money you borrow — be it a credit card. How can a Prepaid Card Improve my Credit Rating? A prepaid card is not based on credit, which means you don't need to have a good credit history to get one.

Can't provide any more detail, beyond the fact it does show up on my credit report as a credit card. Upvote. A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a. Step offers a free FDIC insured bank account and Visa card designed for the next generation. Start building your financial future today! Is a secured card the same as a prepaid card? No. A secured card is a credit card which helps you build a credit history while a debit or prepaid card does not. How can a Prepaid Card Improve my Credit Rating? A prepaid card is not based on credit, which means you don't need to have a good credit history to get one. Build your credit. Unlike most debit or prepaid cards, the Key Secured Credit Card is a real credit card that reports your history to credit bureaus. Make. A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a. Prepaid business credit cards build credit using a lower-risk system. Instead of making you take out a line of credit that's essentially a double-edged sword. The Netspend® Better Credit* Visa Card is a card that fits your lifestyle and can help you build your credit. Other secured charge cards lock your money. We do not offer prepaid credit cards. Find out our tips for building or improving your credit report. Most prepaid cards (sometimes called prepaid debit or stored-value cards) do not help you build a credit history. You might have to pay fees to activate. No, prepaid cards generally do not build credit. Here's why: Prepaid cards vs. credit cards: Prepaid cards: You load money onto the card in. Prepaid cards make it harder to go into debt, but they don't help you build credit. Ultimately, because you are not being extended any credit, a prepaid card does not have any impact on your credit score. Why? Because there is no payment. Why would I use a prepaid card? · Prepaid cards are a convenient way to pay for things if you are not carrying cash. · You do not owe a bill since you are using. No matter how bad your credit score is, you can make things right. Use a prepaid debit card to accept deposits and make payments where needed without the risk. The best way to build credit with a credit card is to use the card responsibly. This means paying your bill on time, every time, and only spending a small. A prepaid debit card can be used like a credit card, but you can only the credit bureaus and will do nothing to improve your credit. Are There. First Progress Platinum Elite Mastercard® Secured Credit Card · Choose your own credit line – $ to $ – based on your security deposit · Build your credit. Prepaid cards and services offer a convenient and secure way to manage your finances. You can use them for everyday purchases, online shopping, budgeting and.

1 2 3 4 5 6